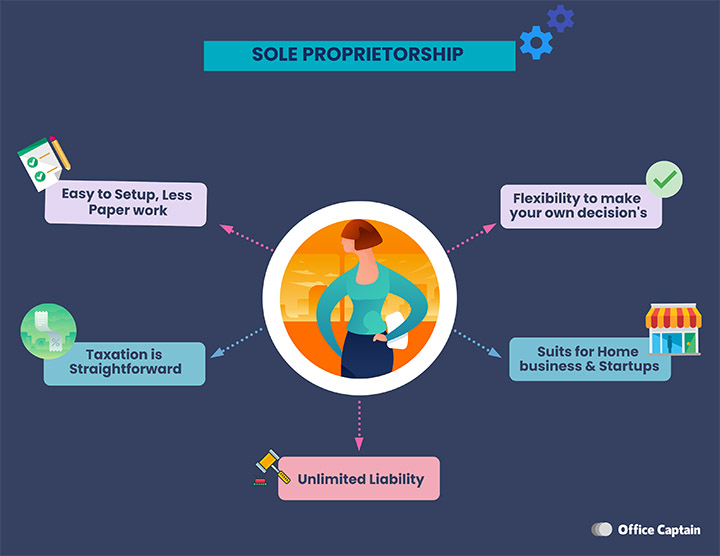

The sole proprietorship is the simplest business form in which all the matters of business are controlled by a single owner, who acts as the sole proprietor.

It is quite easy to set up your startup under sole proprietorship and you need not pay any extra taxes like the large businesses. All the taxes can be paid under individual tax returns.

If you want to start a small business based on your home or a small shop like bakery, salon, boutique, flower shop, or such, then the simplest way you can register your company is under Sole proprietorship. Many home-based businesses as well as retail establishments also opt for this type of ownership.

- Advantages of a Sole Proprietorship

- Easy to Form

- Simplicity and Complete control

- Taxation is Straight Forward

- Trade under your Name or your Business Name

- You can upgrade your Business Ownership

- Privacy

- You can keep all the Profits

- Disadvantages of a Sole Proprietorship

- Unlimited Liability

- Financial Limitations and Limited Capital

- Responsibilities and Heavy Work Load

- Limited Managerial Ability

- Beyond Sole Proprietorship

Several famous companies had initially start as a sole proprietorship or as a partnership firm and later extend to corporations as their business grows.

There are about 23million sole proprietorships in the U.S. Overall, this business ownership represents around 73% of businesses in the United States. It is also usually the same worldwide.

Do you know, some of today’s largest corporations like Walmart, Coca-Cola, eBay, Procter & Gamble started as sole proprietorships.

Advantages of a Sole Proprietorship

Easy to Form

Most of the people who like to start their own business have some sought of a dilemma on doing the registration process.

The process of establishing a Sole proprietorship is easy because of less documentation or paperwork than other business forms. Most of the time, it just requires some permits and necessary business licenses from the respective state and country-level authorities.

Simplicity and Complete control

The owner has complete control over the entire business because the organizational process is not complex at all when compared to other business forms.

You can make the decisions on your own and you don’t need any approvals or any requests to change your business strategies by any other joint partners or the board of directors.

Taxation is Straight Forward

Taxation is another important point in the sole proprietorship because it’s very straightforward as your business is not considered as a separate taxable entity. You can just pay the income generated on your business under your personal tax itself.

Trade under your Name or your Business Name

you can just run your business under your name itself or even you can modulate your name into some sensible and business-oriented names like Lilly’s farm biscuits.

You can upgrade your Business Ownership

Another great point about the sole proprietorship is you have the flexibility to upgrade the status of your startup, from a sole proprietorship to a Business corporation as it grows.

Privacy

Privacy is another major part where the Sole proprietorship has its own advantage. Usually, they won’t require any special reports to be submitted to government authorities.

The things that you might need to submit will be your tax returns and some reports depending upon the rules of the state and central bodies.

You can keep all the Profits

Being the sole proprietor, you can keep all your profits that are generated by your business after paying the taxes. There won’t be any compensations or binding agreements on the income generated.

Disadvantages of a Sole Proprietorship

Along with the advantages, the Sole proprietorship also comes with its own risks or disadvantages

Unlimited Liability

Unlimited liability is the major risk involved with the Sole proprietorship. It is really a major disadvantage that one should consider as you will be legally liable for all the sought’ s of damages that occurred by your startup.

If your business fails, the owner who is the sole proprietor must pay all the debts. In case if you get sued for an accident that happened due to your business activities and in case if you are not covered by appropriate insurances you need to pay everything even from your own property. This is because in a Sole proprietorship you, the sole proprietor and the business are legally the same and inseparable.

Financial Limitations and Limited Capital

If your startup is a sole proprietorship then there can be some limitations to it mainly related to the financial matters. The capability of a single person to invest and run the startup is quite challenging when compared to a partnership firm or a corporation, which can raise funds from different sources.

If you have an unstable financial pillar, the chances of failure in your startup are really high as most of the startups shut down due to the financial issues.

Having a high capital is always beneficial because it enables several technological advancements and to hire more skilled employees.

Responsibilities and Heavy Work Load

Being a sole proprietor, you need to have a business mindset and bear all the responsibilities. Although you can enjoy great pride in running your business in your own style, there is one downside to it.

You must get ready to manage all the heavy workload by yourself which can make you stressful sometimes.

Limited Managerial Ability

Another disadvantage of a sole proprietorship is managerial abilities. Being the person who looks after the entire business with respect to its flow and development, a sole proprietor may not have all the skills required like technological matters, accounting, and marketing to run the business successfully.

Only a few individuals possess enough skills to make better decisions. If the owner lacks the necessary skills, the results may not be as perfect due to the lack of clear strategy and mismanagement.

| Factors | Sole proprietorship |

|---|---|

| Formation | Easy to establish and requires less paperwork |

| Capital | Mostly from personal sources |

| Ability to raise investments | Usually low |

| Taxation | No separate taxation (Owner can pay taxes under his personal returns) |

| Liability | Unlimited liability |

| Continuity | End’s on owner’s death unless they specify their heir legally |

| Management | Most of the work load needs to be managed by their own |

Beyond Sole Proprietorship

If you think that sole proprietorship is not a great option considering your requirements like high capital or hiring skilled employees, etc. You can choose other forms of ownership like partnership firms or corporations.

Add comment